Elderly Property Tax Credit

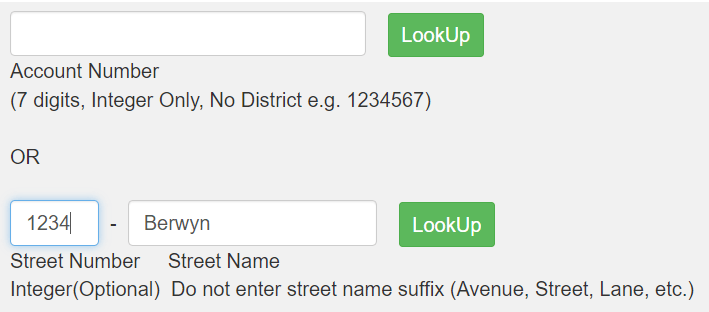

| As outlined in County Bill CB-029-2022, Prince George’s County will provide up to a 20% credit of the County portion of the property tax bill, inclusive of any Homeowners and Homestead Credit (total max of 20%), for up to 5 years to qualified homeowners. To be eligible for this credit the applicant must meet the following criteria as of June 30, 2023, to receive the credit for Fiscal Year 2024, which is tax billing period July 1, 2023 – June 30, 2024: -At least one homeowner is age 65 and over; AND -The same homeowner has resided at the property for which the credit is sought for at least the previous 10 fiscal years; AND -The assessed value of the property does not exceed $500,000; AND –The application is received by October 1, 2023. If you have questions, please email: prop_tax_credits@co.pg.md.us or call 301-952-4030.The Elderly Property Tax Credit paper application is available in English and Spanish, by clicking here. (https://www.princegeorgescountymd.gov/410/Forms) A document of Frequently Asked Questions is also available by clicking here. (https://www.princegeorgescountymd.gov/419/Residential) You can apply for the credit online going to the County’s Property Tax Credit Application page and entering your tax account # or street number and street name, then click the Lookup button like you see below: |

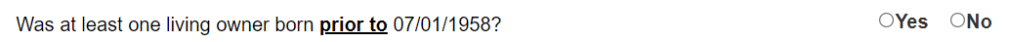

This will take you to the application. Scroll past your tax information to the bottom of the page, and answer the following question about your birthdate:

If you click the circle to the left of “Yes,” you will receive further information about the credit.